Hiring across borders has never been easier. But once the hiring is done, the real question follows: how do you actually pay that developer in Armenia, or that designer in Mexico — legally, efficiently, and without burning through your margins?

The Problem with Global Payments

Paying someone in another country isn’t just about sending money through Wise or Payoneer and hoping for the best. Depending on the country, the nature of work, and the legal structure of the relationship, you could run into:

- Withholding obligations

Some countries expect companies to withhold tax or social contributions — even if you don’t have a local entity. Failing to do so can result in penalties for the company or double taxation for the worker.

- Misclassification risks

If your “contractor” is treated like an employee (defined schedule, ongoing relationship, core responsibilities), that opens you up to legal action — especially in countries like France or Spain.

- Currency issues and local banking limitations

Some workers simply can’t accept international wires. Others receive funds minus unpredictable fees or currency losses. Not to mention delays.

- Limited access to official documents

For your books to be in order, especially with auditors or tax authorities, you need to provide contracts, work completion acts, or invoices that reflect each transfer. Not every method provides these.

Let’s break down the most common options and where they fall short:

Option 1: Direct Bank Transfer

✅ Familiar and widely accepted

❌ High fees for both sender and receiver (especially via SWIFT)

❌ Often lacks documentation and clarity on local tax implications

❌ Risky if you’re not registered as a legal employer

Option 2: Use a Payroll Provider or EOR

✅ Fully compliant if set up correctly

✅ Employer obligations handled

❌ Expensive (20–30% markup is common)

❌ Overkill if you only need to pay one contractor in a country

Option 3: PayPal, Crypto, Local Wallets

✅ Quick and flexible

❌ Not legally recognized in all countries

❌ Documentation is messy or non-existent

❌ Workers may face extra conversion fees or legal uncertainty

Why We Built uDelta

We built uDelta for a simple reason: clients kept asking how to pay international hires, and we had no clear solution to offer. As a recruitment agency, we understood the hiring side inside out. But when it came to compensation logistics, we were stuck.

So we created a tool that would let us handle payments for our own hires abroad, and do it cleanly, transparently, and with paperwork. It worked so well internally that we opened it up to others.

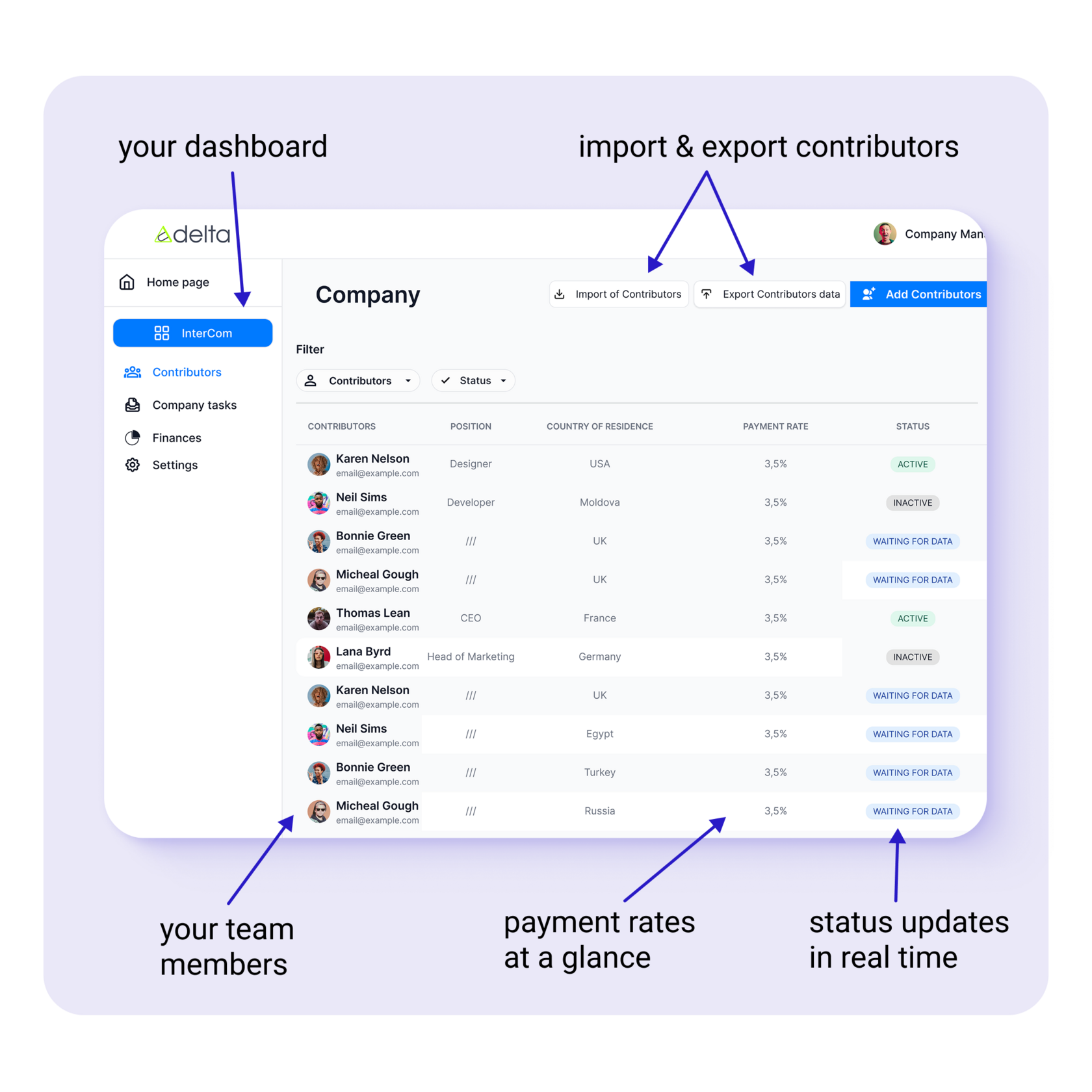

What uDelta Offers

Instead of juggling six platforms, wondering if you’re breaking any laws, or eating unpredictable fees — we offer:

- One agreement. No need to draft a separate contract for each country

- Legal framework. Documents and workflows that support clean compliance

- Multiple payout methods. Bank, crypto, etc.

- Flat, transparent fees. You’ll know the cost before you send anything

- Paper trail. Invoices and annexes generated automatically

You don’t need a full team to get started — we handle payouts even if you’re working with just one contractor abroad.

Just focus on growing your team, and we’ll take care of the rest.

Contact us to learn more! 👉 mail@udelta.io